1099 Fillable Form

- 20 November 2023

As a freelancer or independent contractor, one critical aspect of managing your finances includes understanding and appropriately utilizing the IRS Form 1099. This form is a significant part of the United States tax system used to report various types of income other than wages, salaries, and tips. Specifically, if you've done work for a client or company and earned more than $600 during the tax year, you should receive a Form 1099 from that entity reporting your income to the IRS. This form proves the income you need to report on your tax return. This article is aimed to help you navigate IRS Form 1099 in a fillable PDF and e-file this document without effort.

Navigating the Fillable Form 1099

Thanks to technological advances, the IRS now provides a 1099 fillable form for the 2023 tax year, which can simplify the process of filing your taxes. The fillable version allows you to enter your information directly into a PDF form, which can be printed or submitted electronically. This digital option is designed to make preparing, correcting, and filing your tax documents more straightforward and secure while reducing the chance of human error that can come with manually completing paper forms.

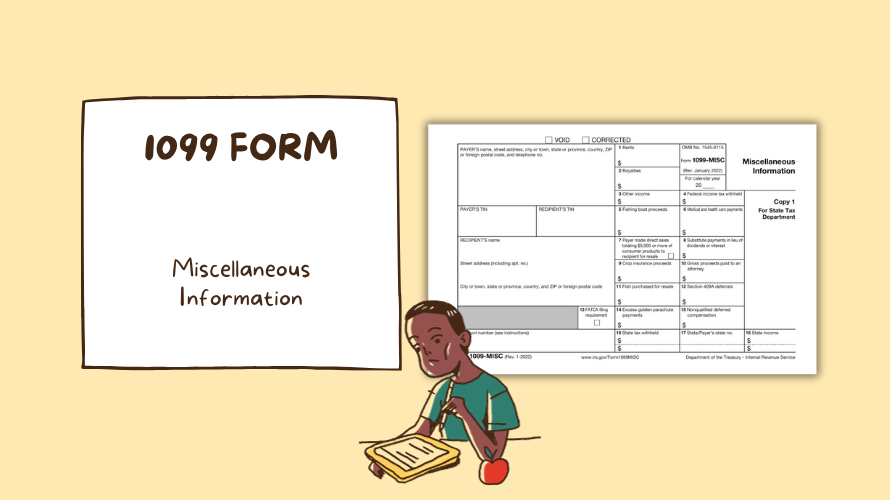

1099-MISC Fillable Form: Addressing Potential Challenges

While the online 1099 fillable form is intended to streamline tax reporting, users may encounter specific difficulties. These can range from technical issues, like trouble downloading or opening the PDF, to confusing instructions related to specific form inputs. It's crucial to have the latest version of a PDF reader installed on your computer to avoid these issues. Additionally, ensure your internet connection is stable before starting the process to prevent disruptions that could lead to lost data.

Best Practices for Filling Out Your 1099 Form Online

To successfully complete your blank fillable 1099 form, adhering to certain best practices is essential.

- Firstly, review the income statements you've received from clients or employers throughout the year to ensure all information you report is accurate and complete.

- Double-check your social security number, taxpayer identification number, and all other personal information for accuracy.

- Additionally, if you're filing multiple 1099 forms, be consistent with your information across all documents.

Each box on the fillable Form 1099 corresponds to a specific type of income or deduction. Ensure you understand each box and file the correct amounts in the right boxes to avoid processing delays or audits. If you're unsure about any part of the form or need personalized advice, consider consulting a tax professional. They can address your situation, guide you through the process, and help you avoid costly mistakes.