Printable 1099 Form

- 21 November 2023

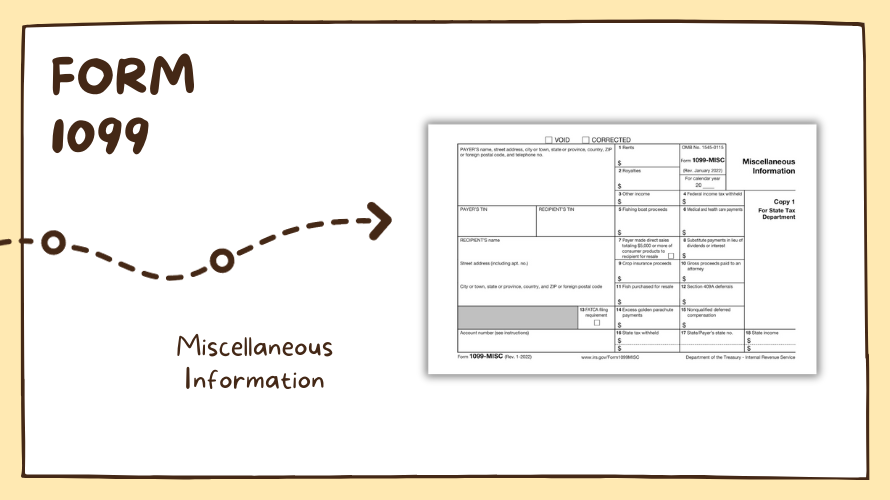

Regarding freelance work, taxes can seem daunting, but understanding the printable IRS 1099 form layout can ease this process significantly. This form reports various types of income, from freelance earnings to interest and dividends. The IRS 1099 form has multiple versions, but the standard form for reporting non-employee compensation is the 1099-NEC. It's crucial to grasp the main sections, which include the payer's information, the recipient's tax identification number and details, the amount paid during the tax year, and any taxes withheld. Recognizing these sections can aid in ensuring accurate reporting of your earnings.

Steps to Complete 1099 Printable Form

Correctly filling out the printable 1099 form for 2023 is key to avoiding tax issues. Here are some easy-to-follow points to guide you:

- Gather Information

Compile the required data, such as Taxpayer Identification Numbers (TINs), addresses, and the total payments made throughout the year. - Payer Details

Include your TIN and address as the payer. - Recipient Data

Fill in the recipient's TIN along with their address. - Report Income

Input the total amount paid to the recipient in the appropriate boxes. Ensure all amounts are accurate to the cent. - Review

Check all the data for accuracy. Any errors in the TINs or payment amounts can lead to fines or the need to submit corrected forms.

Guidelines for IRS Tax Form 1099 Filing

Once you have your completed income tax form 1099 printable, filing it is the next critical step. You'll need to send Copy A to the IRS to do this. Remember that for certain forms, like the 1099-NEC, Copy A must be mailed with a Form 1096, which acts as a cover sheet. You can mail or file the forms electronically, but if you have more than 250 forms to file, electronic submission is mandatory. Always retain a copy of the form for your records.

For freelancers with multiple clients, the convenience of the Form 1099 printable template cannot be overstated. This essential document is conveniently available for download on our website and can be printed for manual completion or filled out electronically before printing.

Printable 1099-MISC Form for 2023: Remember the Deadline

Tax deadlines are crucial to adhere to to avoid penalties. For the tax year 2023, the deadline for sending the completed printable 1099 form to both the IRS and the recipient is January 31, 2024.

This deadline applies to most types of 1099 forms, including the 1099-NEC, which is particularly relevant to freelancers and independent contractors. Mark your calendar to ensure that you don't miss these important dates.

Handling your taxes as a freelancer can be a breeze when you're armed with the right information and tools. Look for a blank printable 1099 form, familiarize yourself with the layout, meticulously complete each section, and file it promptly, and you'll be set until the next tax season rolls around.