Role of IRS Form 1099-MISC in the U.S. Taxation System

IRS Form 1099 is an essential document used to report various types of income aside from wages, salaries, and tips. It is particularly pertinent for freelancers, independent contractors, and self-employed individuals who have received income throughout the tax year. Reporting this income to the Internal Revenue Service is critical in calculating accurate tax liabilities, making the 1099 self-employed form a vital piece of paperwork come fiscal season.

Our Website Advantages

Navigating the complexities of tax documents can be daunting, but resources like free-1099-form.com offer invaluable assistance. With our comprehensive materials that include step-by-step instructions and up-to-the-minute examples, users can confidently tackle filling out their 1099 template for 2023 hassle-free. Our website provides the 1099 form for download for free and helps with the filling process to ensure compliance with federal tax regulations. This support especially benefits those dealing with the 1099 copy for the first time.

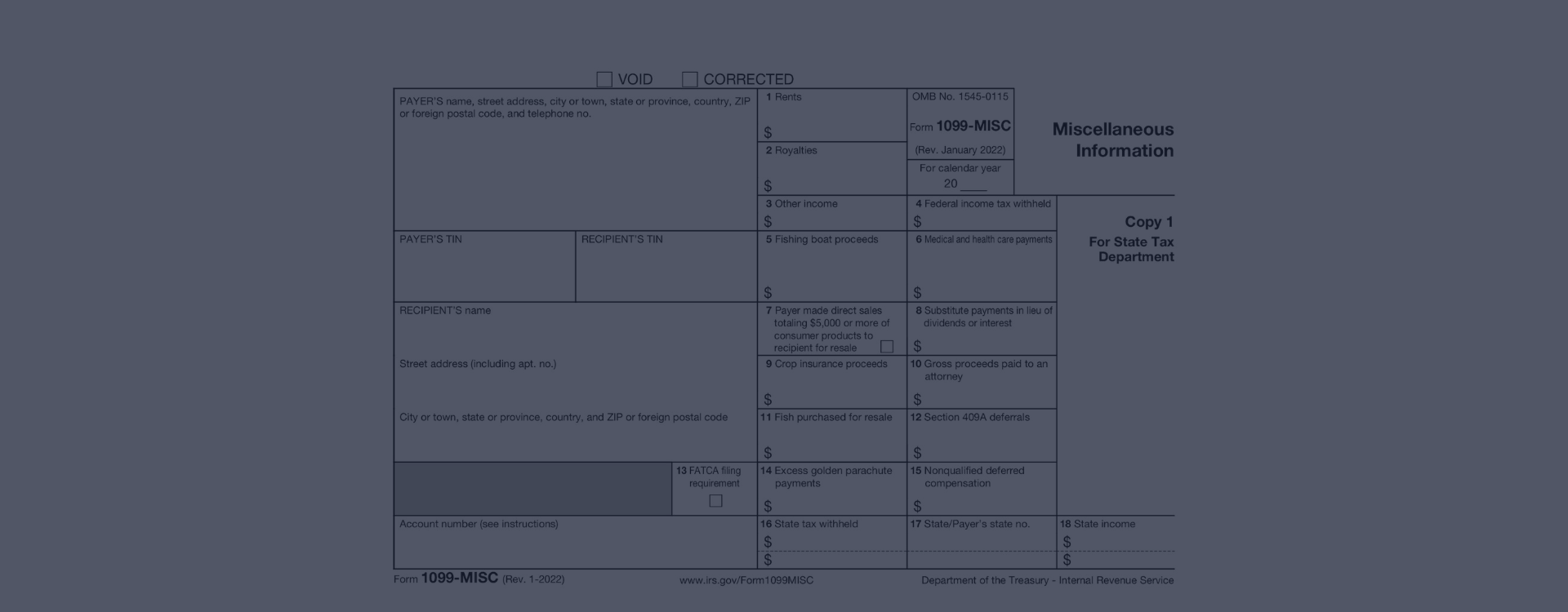

About Miscellaneous Information

In the realm of the 1099 form, Miscellaneous Information refers to various types of payments or income received that is not classified as wages or salary. These could include things such as rental income, royalties, non-employee compensation, medical and health care payments, crop insurance proceeds, cash payments for fish (or other aquatic life) purchased from anyone engaged in the trade or business of catching fish, prizes, and awards, and other income.

Features of the 1099 Income Tax Form

-

![Flexibility]() FlexibilityForm accommodates diverse income streams, essential for independent contractors, freelancers, or anyone with non-employee earnings. It simplifies reporting miscellaneous income that doesn't fit the traditional wage framework of a W-2 form.

FlexibilityForm accommodates diverse income streams, essential for independent contractors, freelancers, or anyone with non-employee earnings. It simplifies reporting miscellaneous income that doesn't fit the traditional wage framework of a W-2 form. -

![Transparency]() TransparencyUsing the IRS 1099-MISC form ensures clarity for both service providers and the Internal Revenue Service. It records payments made and received, facilitating year-end financial tracking and tax filing by explicitly detailing miscellaneous incomes.

TransparencyUsing the IRS 1099-MISC form ensures clarity for both service providers and the Internal Revenue Service. It records payments made and received, facilitating year-end financial tracking and tax filing by explicitly detailing miscellaneous incomes. -

![Compliance]() ComplianceFiling a 1099-MISC form helps maintain tax compliance, as it's a critical IRS requirement for any business or individual making certain types of payments. Non-compliance can lead to penalties, so properly using this form helps avoid complications.

ComplianceFiling a 1099-MISC form helps maintain tax compliance, as it's a critical IRS requirement for any business or individual making certain types of payments. Non-compliance can lead to penalties, so properly using this form helps avoid complications.

Fill Out 1099 Form Online

Get FormObligation to File the 1099 Tax Form for Subcontractors

In the United States, the 1099 form is a crucial tax document for individuals and entities that are not employed traditionally but have received income outside of a regular salary or wages. The IRS demands individuals to fill in Form 1099-MISC for various income transactions, including but not limited to self-employment earnings, interest, dividends, government payments, and more.

Take Sarah, a graphic designer who has embraced the freelance lifestyle. Sarah works from her home studio and provides services to various businesses without being on any company's payroll. Throughout the year, she accumulates substantial fees from different clients. To comply with tax regulations, Sarah must obtain a free 1099 form for 2023, as she received payments exceeding the threshold set by the IRS from multiple clients, necessitating the proper reporting of her amassed income.

Another example is James, a retired carpenter who now fills his time with independent contracting work. This past year, he undertook several significant woodworking projects for local businesses and individuals. Given his status as a self-employed individual, James must utilize the 1099 form for independent contractor in PDF format, clearly outlining his income from such gigs. To align with the IRS's requirements, he must fill out the 1099-MISC accurately for his financial records, keeping his taxes in good standing.

Printable 1099 Form: Filling Instructions for 2023

Navigating your tax obligations can be a daunting task, but with the right tools and know-how, you can handle your duties efficiently. If you are an independent contractor or freelancer, chances are you'll need to become familiar with the 1099 form. Thankfully, you can access a free online 1099 form template to simplify this process.

- When you're ready to file the 1099-MISC for free, the first thing to ensure is that all payer and recipient information is accurate. This includes legal names, addresses, and tax identification numbers. These crucial details belong in the designated boxes at the top of the form.

- Moving on to the form's body, you must fill out the financial information relevant to the non-employee compensation, rents, royalties, or any other income paid.

- To prevent errors while completing the form, double-check each entry. It's also advisable to gather all necessary documents beforehand, such as invoices and payment records, to report the correct amounts.

- After ensuring the data's accuracy, you can then print the 1099 tax form for free directly from the site you are using.

- Remember to keep copies for yourself before distributing the documents to the payees and the IRS, maintaining proper records of all transactions.

File Form 1099 on Time

For those needing a free 1099 printable form for 2023, it's essential to know the due date for filing. Taxpayers are required to file the 1099 form to the Internal Revenue Service (IRS) by January 31 of the year following the tax year in which income payments were made. This deadline is applicable if you are reporting non-employee compensation payments in box 7 of the form.

Get FormTax Form 1099-MISC & IRS Penalties

It is crucial to avoid the penalties that come with tardy submissions or submitting inaccurate information. Should you fail to file the 1099 form example on time, the IRS can impose penalties ranging from $50 to $270 per copy, depending on how late the document is filed. Additionally, intentional disregard for filing or providing falsified information can result in a minimum penalty of $550 per statement, with no maximum limit.

1099 Form Template: Frequently Asked Questions

- Where can I find a 1099 form printable for free?Use our website to obtain a 1099 form without cost. Click the "Get Form" button to open the template in the new window. You can enter the information directly into the editable fields and print the document or save the blank template for further use.

- What is the deadline for sending out 1099 forms?Typically, you must send the completed 1099 copies to your contractors and the IRS by January 31st, following the tax year. However, if January 31st falls on a weekend or a holiday, the deadline may be moved to the next business day. It's crucial to adhere to these deadlines to avoid potential penalties.

- Is there a free fillable 1099 form available online?Yes, you can take advantage of the editable 1099 form and complete it on your computer. This format is preferred as it is both error-reducing and environmentally friendly, plus it can be easily saved and accessed for your records. Ensure you're downloading the latest version to comply with current tax laws.

- How do I know if I need to issue a 1099 form?You must issue a free printable 1099 tax form if you have paid an independent contractor who is not an employee at least $600 for services during the fiscal period. It's a key tax compliance component for freelancers and those who utilize freelance services. Not issuing a 1099 when necessary can result in penalties from the IRS.

- Can I print the 1099 form for free if I have multiple to file?Yes, regardless of the number of 1099 forms you need to file, you can print a copy for each of your contractors from our website. Ensure you have a printer that can handle the task and sufficient ink since the reports must be legible and error-free when submitted.

- Where can I get a free blank 1099 form for tax preparation?You can access a blank copy by following the link from our website. It allows you to start your tax preparations at no additional cost. Remember that this document must be compatible with IRS specifications, so following the guidelines is imperative.

More Form 1099 Instructions for 2023

Printable 1099 Form Regarding freelance work, taxes can seem daunting, but understanding the printable IRS 1099 form layout can ease this process significantly. This form reports various types of income, from freelance earnings to interest and dividends. The IRS 1099 form has multiple versions, but the standard form fo...

Printable 1099 Form Regarding freelance work, taxes can seem daunting, but understanding the printable IRS 1099 form layout can ease this process significantly. This form reports various types of income, from freelance earnings to interest and dividends. The IRS 1099 form has multiple versions, but the standard form fo... - 21 November, 2023

- 1099 Fillable Form As a freelancer or independent contractor, one critical aspect of managing your finances includes understanding and appropriately utilizing the IRS Form 1099. This form is a significant part of the United States tax system used to report various types of income other than wages, salaries, and tips....

- 20 November, 2023

- 1099 Tax Form (PDF) Understanding the history of the 1099 tax form helps us appreciate its role in the modern tax system. The inception of Form 1099 dates back several decades as part of the IRS's efforts to ensure accurate reporting of non-employee income. Initially designed as a simple mechanism to report miscellaneo...

- 17 November, 2023

Please Note

This website (free-1099-form.com) is an independent platform dedicated to providing information and resources specifically about the free Form 1099, and it is not associated with the official creators, developers, or representatives of the form or its related services.